ALX Resources Corp. Reports Drill Results from the Alligator Lake Gold Project, SK

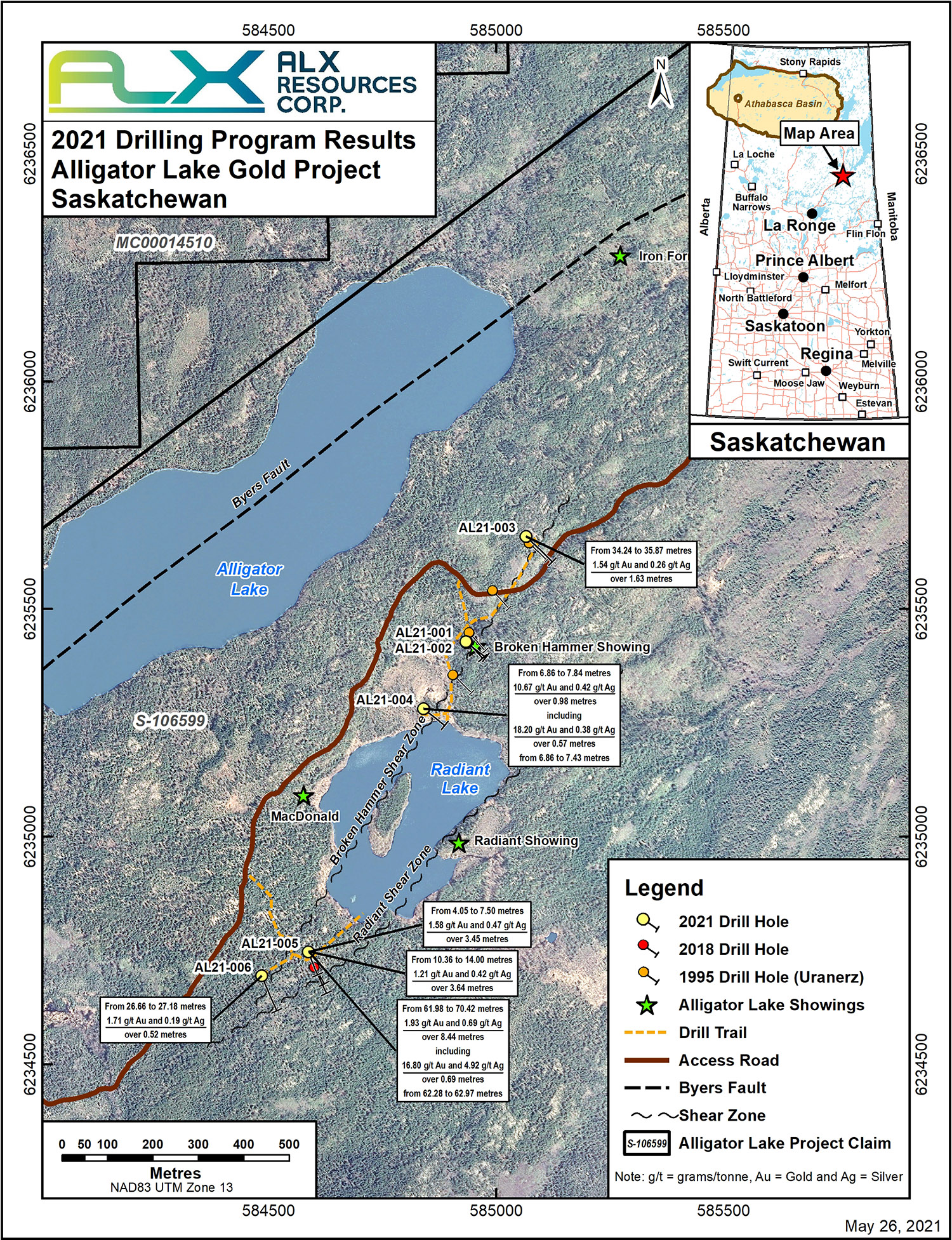

ALX Resources Corp. (“ALX” or the “Company”) (TSXV: AL; FSE: 6LLN; OTC: ALXEF) is pleased to announce the results of the 2021 drilling program at the Alligator Lake Gold Project (“Alligator”, or the “Project”) located approximately 165 kilometres (103 miles) northeast of La Ronge, SK, Canada. ALX’s inaugural drilling program was completed in March 2021 and successfully intersected the targeted Broken Hammer Shear Zone, which is known to be prospective for high-grade gold mineralization.

ALX’s 2021 drilling at Alligator consisted of six NQ-size diamond drill holes totaling 617.6 metres (2,026 feet) focussed along an approximate 1,000-metre section of the Broken Hammer Shear Zone where ALX had previously sampled a sulphide-bearing quartz vein in outcrop at the Broken Hammer Showing that returned 504.0 grams/tonne (“g/t”) gold (16.13 oz/ton), and 46.2 g/t silver, by fire assay (see ALX news release dated March 15, 2021). ALX’s drilling encountered significant gold mineralization in multiple holes, which has provided a strong basis for follow-up drilling and ground exploration across the Broken Hammer Shear Zone and elsewhere at the Project. Visible gold was encountered in hole AL21-005 in five locations, and in two locations in hole AL21-006 at (see ALX news release dated March 25, 2021). Gold and silver fire assay results are shown in the table below, for intersections grading over 1.0 g/t gold:

Alligator Lake 2021 Drilling Results Greater than 1.0 g/t Gold

| Hole Number |

Depth of Hole (metres) |

From (metres) |

To (metres) |

Interval 1 (metres) |

Gold (g/t) |

Silver (g/t) |

| AL21-003 | 111.0 | 34.24 | 35.87 | 1.63 | 1.54 | 0.26 |

| AL21-004 | 81.0 | 6.86 | 7.84 | 0.98 | 10.67 | 0.42 |

| including | 6.86 | 7.43 | 0.57 | 18.20 | 0.38 | |

| AL21-005 | 120.0 | 4.05 | 7.50 | 3.45 | 1.58 | 0.47 |

| including | 5.00 | 5.50 | 0.50 | 5.66 | 0.59 | |

| and | 6.94 | 7.50 | 0.56 | 4.01 | 0.63 | |

| 10.36 | 14.00 | 3.64 | 1.21 | 0.42 | ||

| 61.98 | 70.42 | 8.44 | 1.93 | 0.69 | ||

| including | 62.28 | 62.97 | 0.69 | 16.80 | 4.92 | |

| and | 65.08 | 66.27 | 1.19 | 1.88 | 0.42 | |

| AL21-006 | 120.0 | 26.66 | 27.18 | 0.52 | 1.71 | 0.19 |

1 All mineralized intersections described in this table are shown as measured drill core lengths – true widths of mineralized zones are not yet determined.

Highlights of the Alligator Lake 2021 Drilling

- ALX’s drilling confirmed quartz veining with associated sulphides and gold mineralization at shallow depths in every hole.

- The highest gold grades occurred in holes AL21-004 and AL21-005, which were drilled approximately 600 metres apart, each located on land to the north and south of Radiant Lake. Highly-anomalous gold values ranging up to 229 parts per billion were found in historical lake sediment samples from Radiant Lake where recommended drill targets remain to be tested.

- The overall grades of gold mineralization are variable, but occur in several different rock types, e.g., granodiorite, psammite and greywacke, and therefore are not confined to one particular geological strata.

Future Exploration Plans at Alligator Lake

ALX is planning summer work in 2021 consisting of geological mapping and prospecting, and may include trenching in areas where high-grade gold mineralization has been intersected just below the overburden at depths as little as four (4) metres. ALX also plans to carry out a high-resolution airborne or drone magnetic survey at the Project in order to gain valuable information for the development of winter drilling targets at Alligator in 2022.

To view maps of Alligator click here

About Alligator Lake

Alligator consists of five claims totaling 2,973.32 hectares (7,347.24 acres) and is located adjacent to Provincial Highway 102, with an established winter trail suitable for mobilizing drilling equipment directly to ALX’s primary areas of interest. The Project has been held since 1985 by a private company and has been the subject of a number of seasonal prospecting programs, some geophysical surveying and limited drilling. Prior to ALX’s 2021 work, only 16 diamond drill holes have been drilled since 1995 to depths averaging less than 86 metres.

The Project is underlain by Precambrian Shield rocks of the Central Metavolcanic Belt (“CVB”), part of the La Ronge Domain. Northeast-striking and steeply northwest-dipping upper greenschist to lower amphibolite facies ultramafic to mafic metavolcanic rocks of the CVB are intruded by ultramafic to mafic sills. These ultramafic to mafic rocks are structurally underlain by similarly northeast-striking and northwest-dipping meta-arkose and calcareous metagreywackes of the McLennan‐Sickle Group.

The dominant structural feature at Alligator is the Byers Fault, which strikes in a northeasterly direction and dips to the northwest. The Byers Fault can be traced along the southeast shore of Alligator Lake and through a series of topographic lows. The Byers Fault is recognized as a “first‐order” controlling structure for many “second‐order” quartz‐sulphide‐carbonate healed shear and tensional vein type gold deposits and occurrences in the greater Waddy Lake area (Schwann, 1991). In the Waddy Lake area, however, the Byers Fault trends approximately east‐west before stepping/flexing into a more northeasterly trend in the Contact Lake-Alligator Lake area. Large‐scale “bends” in fault systems are known to be the preferential location for dilatancies that could host gold-bearing quartz vein swarms.

In 1995, Uranerz Exploration and Mining (“UEM”) drilled four holes at 100-metre intervals along the Broken Hammer Shear Zone. The best intersection was 7.31 g/t gold (0.23 oz/ton) over 1.5 metres in hole AL‐02, from 38.9 metres to 40.4 metres, beneath the site where visible gold was discovered in the late 1980s (Avery and Leppin, 1995).

In January 2021, ALX and Alligator Resources Ltd. (“ARL”, a private Saskatchewan corporation), executed a definitive agreement for the Project incorporating the terms and conditions of a previously-announced binding letter agreement. The definitive agreement provides ALX with the option to earn an initial 51% interest (the “First Option”) and up to an 80% interest (the “Second Option”) in the Project over a four (4) year period from the effective date of the definitive agreement in consideration for: (a) cash payments totaling $150,000, (b) the issuance of common shares of ALX to ARL totaling 1,500,000 common shares; and (c) ALX incurring eligible expenditures totaling $1,250,000 with respect to the Project.

Upon ALX obtaining an 80% interest in the Project (by exercise of both the First Option and the Second Option), ALX and ARL shall form a joint venture in respect of the development of the Project (with ALX as operator), with the terms of the joint venture agreement to be negotiated in good faith between the parties and executed prior to ALX earning a 51% interest. Alligator is subject to an underlying 2.5% net smelter returns royalty (“NSR”) on the sale of valuable minerals from the Project, of which half of the NSR (1.25%) can be purchased by ALX from the royalty holders at any time for $1.0 million.

National Instrument 43-101 Disclosure

The technical information in this news release has been reviewed and approved by Sierd Eriks, P.Geo., President and Chief Geologist of ALX, who is a Qualified Person in accordance with the Canadian regulatory requirements set out in National Instrument 43-101.

Readers are cautioned that some of the technical information described in this news release is historical in nature; however, the historical information is deemed credible and was produced by professional geoscientists in the years discussed. Historical geochemical results quoted in this news release were taken directly from assessment work filings published by the Government of Saskatchewan and other regulatory filings. Management cautions that historical results collected and reported by past operators have not been verified nor confirmed by its Qualified Person, but create a scientific basis for ongoing work in the Alligator property area.

Geochemical results from 2020 grab samples and ALX’s 2021 drill core samples described in this news release were shipped to SRC Geoanalytical Laboratories in Saskatoon, SK and analyzed using a 4-acid digestion with Inductively Coupled Plasma Mass Spectrometry (ICP-MS). Gold, platinum and palladium were analyzed by fire assay techniques. Certain of the drill core samples were further analyzed by metallic gold assay, or are in process.

About ALX

ALX is based in Vancouver, BC, Canada and its common shares are listed on the TSX Venture Exchange under the symbol “AL”, on the Frankfurt Stock Exchange under the symbol “6LLN” and in the United States OTC market under the symbol “ALXEF”. ALX’s mandate is to provide shareholders with multiple opportunities for discovery by exploring a portfolio of prospective mineral properties, which include gold, nickel, copper, and uranium projects. The Company uses the latest exploration technologies and holds interests in over 200,000 hectares of prospective lands in Saskatchewan and Ontario, stable Canadian jurisdictions that collectively host the highest-grade uranium mines in the world, and offer a significant legacy of production from gold and base metals mines.

ALX owns 100% interests in the Firebird Nickel Project (now under option to Rio Tinto Exploration Canada, who can earn up to an 80% interest), the Flying Vee Nickel/Gold and Sceptre Gold projects, and can earn up to an 80% interest in the Alligator Lake Gold Project, all located in northern Saskatchewan, Canada. ALX owns, or can earn, up to 100% interests in the Vixen Gold Project, the Electra Nickel Project and the Cannon Copper Project located in historic mining districts of Ontario, Canada, and in the Draco VMS Project in Norway. ALX holds interests in a number of uranium exploration properties in northern Saskatchewan, including a 20% interest in the Hook-Carter Uranium Project, located within the prolific Patterson Lake Corridor, with Denison Mines Corp. (80% interest) operating exploration since 2016, and a 40% interest in the Black Lake Uranium Project, a joint venture with UEX Corporation and Orano Canada Inc.

For more information about the Company, please visit the ALX corporate website at www.alxresources.com or contact Roger Leschuk, Manager, Corporate Communications at: PH: 604.629.0293 or Toll-Free: 866.629.8368, or by email: rleschuk@alxresources.com

On Behalf of the Board of Directors of ALX Resources Corp.

“Warren Stanyer”

Warren Stanyer, CEO and Chairman

FORWARD LOOKING STATEMENTS

Statements in this document which are not purely historical are forward-looking statements, including any statements regarding beliefs, plans, expectations or intentions regarding the future. Forward looking statements in this news release include: the Alligator Lake Gold Project (“Alligator”) is prospective for gold mineralization, the Company’s plans to undertake exploration activities at Alligator, and expend funds on Alligator. It is important to note that the Company’s actual business outcomes and exploration results could differ materially from those in such forward-looking statements. Risks and uncertainties include that ALX may not be able to fully finance exploration at Alligator, including drilling; our current findings at Alligator may prove to be unworthy of further expenditure; commodity prices may not support exploration expenditures at Alligator; and economic, competitive, governmental, societal, public health, environmental and technological factors may affect the Company’s operations, markets, products and share price. Even if we explore and develop Alligator, and even if gold or other metals or minerals are discovered in quantity, the project may not be commercially viable. Additional risk factors are discussed in the Company’s Management Discussion and Analysis for the Year Ended December 31, 2020, which is available under the Company’s SEDAR profile at www.sedar.com. Except as required by law, we will not update these forward-looking statement risk factors. Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release