ALX Resources Corp. Stakes Additional Claims at the Hydra Lithium Project in Quebec

Vancouver, December 8, 2022 – ALX Resources Corp. (“ALX” or the “Company”) (TSXV: AL; FSE: 6LLN; OTC: ALXEF) is pleased to announce that it has completed a second staking program at the Hydra Lithium Project (“Hydra”, or the “Project”) in the James Bay region of northern Quebec, Canada. ALX staked an additional 108 claims in two claim blocks known as Cobra and Viper, bringing ALX’s total holding in the region to 21,746 hectares (53,734 acres). Hydra is located in a world-class lithium exploration district that hosts several significant lithium-cesium-tantalum (“LCT”) type pegmatites. Hydra is 100%-owned by ALX with no applicable royalties and the Cobra and Viper claims are in good standing until November 2025.

Highlights of ALX’s 2022 Exploration Activities at Hydra

- Cobra and Viper were staked after further geological assessment of the area, which targeted discrete greenstone formations that have potential to host LCT-type pegmatites;

- ALX performed site visits on four sub-projects (Volta, Sprite, Nike and Echo) at Hydra in October 2022. The helicopter-assisted reconnaissance prospecting was successful in locating pegmatite bodies in several locations, despite the onset of poor weather conditions limiting the scope of the program;

- Samples were submitted to SGS Canada Inc. for multi-element analysis including lithium, cesium, and tantalum. Results are expected in December 2022 and will be released following their receipt, compilation and interpretation.

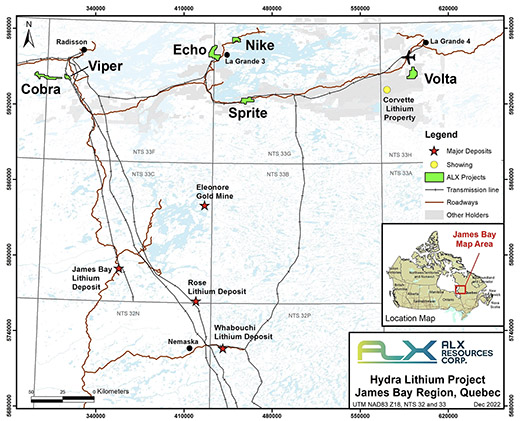

ALX’s Hydra Lithium Project claims in the James Bay Region, Quebec

2022-2023 Exploration Plans

Compilation of historical data related to Hydra and other areas in the region that are prospective for LCT pegmatites is ongoing. Following receipt of the results of the 2022 prospecting, ALX is planning a high-resolution magnetic, radiometric, and photogrammetric survey in early 2023 to provide additional geophysical, topographic, and aerial visual information to aid in the location and mapping of pegmatite bodies. In the 2023 field season, follow-up geological and geochemical surveys are planned across the highest-priority areas in order to delineate potentially lithium-bearing pegmatite dykes and sills and to optimize resultant drill targets.

To view maps and more information on Hydra, visit our website at: https://alxresources.com/hydra-lithium/

About Hydra

Hydra now consists of six sub-projects totaling 21,746 hectares (53,734 acres) known as Volta (4,806 ha.), Echo (5,537 ha.), Nike (2,056 ha.), Sprite (3,438 ha.), Cobra (4,249 ha.) and Viper (1,280 ha.), all located within a fertile mineral exploration district that is known to host the following existing lithium deposits:

- James Bay Lithium – (Indicated Mineral Resource: 40.33 million tonnes grading 1.4% Li2O), owned by Allkem Limited;1

- Rose – (Probable: 26.3 million tonnes grading 0.87% Li2O and 138 ppm Ta2O5), owned by Critical Elements Lithium Corporation;2

- Whabouchi – (Measured + Indicated “in Pit” Mineral Resource: 37.356 million tonnes grading 1.48% Li2O), owned by Livent Corporation and Investissment Québec.3

1 Preliminary Economic Assessment, NI 43-101 Technical Report, James Bay Lithium Project Ontario Canada, by G Mining Services, March 8, 2021

2 Rose Lithium-Tantalum Project Feasibility Study NI 43-101 Technical Report, by Simon Boudreau, P.Eng., May 27, 2022

3 NI 43-101 Technical Report on the Whabouchi Lithium Mine and Shawnigan Electrochemical Plant, by Met-Chem et al, November 7, 2018

ALX believes that Hydra is underexplored for LCT pegmatites because of the high prospectivity of the region, as suggested by the Corvette Lithium Deposit, and due to the fact that the historical focus of exploration in the James Bay Region has been on gold and base metals. The James Bay Hydroelectric Project (total investment by Hydro-Québec is estimated at greater than CAD$16 billion since the early 1970s) has created infrastructure for mineral exploration in the form of several all-weather roads, including the Trans-Taiga Road. Serviceable airstrips are located in the vicinity providing aircraft support capability for Hydra.

National Instrument 43-101 Disclosure

The technical information in this news release has been reviewed and approved by John Charlton, P.Geo., a consultant to ALX, who is a Qualified Person in accordance with the Canadian regulatory requirements set out in National Instrument 43-101.

Mineral resource information from lithium deposits in the James Bay region quoted in this news release were taken directly from publicly available disclosure. Management cautions that historical results were collected and reported by operators unrelated to ALX and have not been verified nor confirmed by its Qualified Person but create a scientific basis for ongoing work in the Hydra project area. Management further cautions that historical results or discoveries on adjacent or nearby mineral properties are not necessarily indicative of the results that may be achieved on ALX’s mineral properties.

About ALX

ALX is based in Vancouver, BC, Canada and its common shares are listed on the TSX Venture Exchange under the symbol “AL”, on the Frankfurt Stock Exchange under the symbol “6LLN” and in the United States OTC market under the symbol “ALXEF”.

ALX’s mandate is to provide shareholders with multiple opportunities for discovery by exploring a portfolio of prospective mineral properties, which include uranium, lithium, nickel-copper-cobalt and gold projects. The Company uses the latest exploration technologies and holds interests in over 220,000 hectares of prospective lands in Saskatchewan, a stable Canadian jurisdiction that hosts the highest-grade uranium mines in the world, a producing gold mine, and production from base metals mines, both current and historical.

ALX’s uranium holdings in northern Saskatchewan include 100% interests in the Gibbons Creek Uranium Project, the Sabre Uranium Project and the Javelin and McKenzie Lake Uranium Projects, a 40% interest in the Black Lake Uranium Project (a joint venture with Uranium Energy Corporation and Orano Canada Inc.), and a 20% interest in the Hook-Carter Uranium Project, located within the uranium-rich Patterson Lake Corridor, with Denison Mines Corp. (80% interest) as operator of exploration since 2016.

ALX owns 100% interests in lithium exploration properties staked in 2022 known as the Hydra Lithium Project, located in the James Bay region of northern Quebec, Canada, and a 100% interest in the Anchor Lithium Project, located in Nova Scotia.

ALX also owns 100% interests in the Firebird Nickel Project (now under option to Rio Tinto Exploration Canada Inc., who can earn up to an 80% interest), the Flying Vee Nickel/Gold and Sceptre Gold projects, and can earn up to an 80% interest in the Alligator Lake Gold Project, all located in northern Saskatchewan, Canada. ALX owns, or can earn, up to 100% interests in the Electra Nickel Project and the Cannon Copper Project located in historic mining districts of Ontario, Canada, the Vixen Gold Project (now under option to First Mining Gold Corp., who can earn up to a 100% interest in two stages), and in the Draco VMS Project in Norway.

For more information about the Company, please visit the ALX corporate website at www.alxresources.com or contact Roger Leschuk, Manager, Corporate Communications at: PH: 604.629.0293 or Toll-Free: 866.629.8368, or by email: rleschuk@alxresources.com

On Behalf of the Board of Directors of ALX Resources Corp.

“Warren Stanyer”

Warren Stanyer, CEO and Chairman

FORWARD-LOOKING STATEMENTS

Statements in this document which are not purely historical are forward-looking statements, including any statements regarding beliefs, plans, expectations or intentions regarding the future. Forward-looking statements in this news release include: ALX’s 2022-2023 exploration plans at the Hydra Lithium Project, and ALX’s ability to continue to expend funds at that project. It is important to note that the Company’s actual business outcomes and exploration results could differ materially from those in such forward-looking statements. Risks and uncertainties include that ALX may not be able to fully finance exploration on our exploration projects, including drilling; our initial findings at our exploration projects may prove to be unworthy of further expenditures; commodity prices may not support further exploration expenditures; exploration programs may be delayed or changed due to any delays experienced in consultation and engagement activities with First Nations and Metis communities and the results of such consultations; and economic, competitive, governmental, societal, public health, environmental and technological factors may affect the Company’s operations, markets, products and share price. Even if we explore and develop our projects, and even if uranium, lithium, nickel, copper, gold or other metals or minerals are discovered in quantity, ALX’s projects may not be commercially viable. Additional risk factors are discussed in the Company’s Management Discussion and Analysis for the Nine Months Ended September 30, 2022, which is available under the Company’s SEDAR profile at www.sedar.com. Except as required by law, we will not update these forward-looking statement risk factors.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release